Health Saving Account

The Magic Of HSA

The Health Savings Account or HSA is one of the most powerful pieces of a well-designed health care strategy. The HSA puts you in control of your own healthcare strategy. It is helping you to save on taxes, cut costs, and build wealth for future healthcare expenses.

What are the benefits of a HSA?

The Health Savings Account (HSA) includes several significant benefits, all explained more fully below:

- Saving on taxes with a great above-the-line tax deduction.

- Creating a tax-free ‘bucket’ you can take with you anywhere you want (a portable IRA).

- Building this ‘bucket’ with any type of investment.

- The potential to save on health insurance premiums.

- Saving on health care costs by paying cash for services.

- The ability to pull out cash tax-free at any age for a long list of medical expenses and services.

Do I get tax deductions of a HSA contribution?

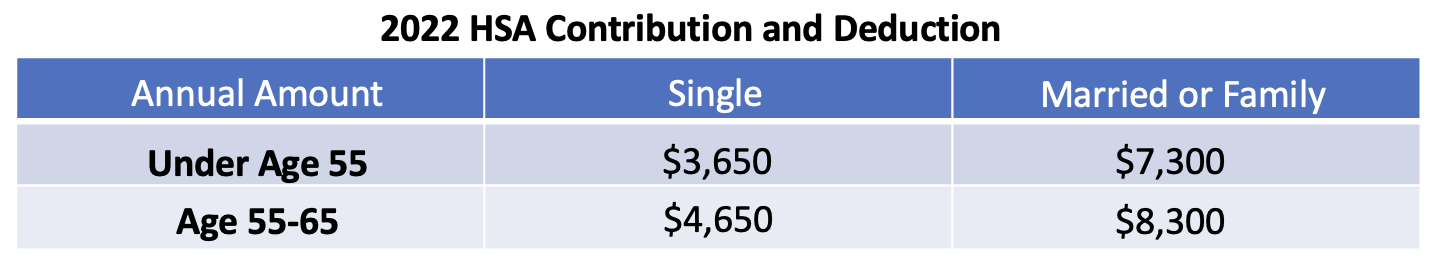

Yes,your HSA contributions are deductible from your gross pay, or business income, on the front page of your tax return. No income limits! No phasing out! Married or Single! Kids or no Kids! Entrepreneur or W-2 Employee! The HSA gives you a powerful tax deduction and can potentially even put you into a lower tax bracket. Here are your numbers for 2022:

Do I need Qualifying Health Insurance to start HSA?

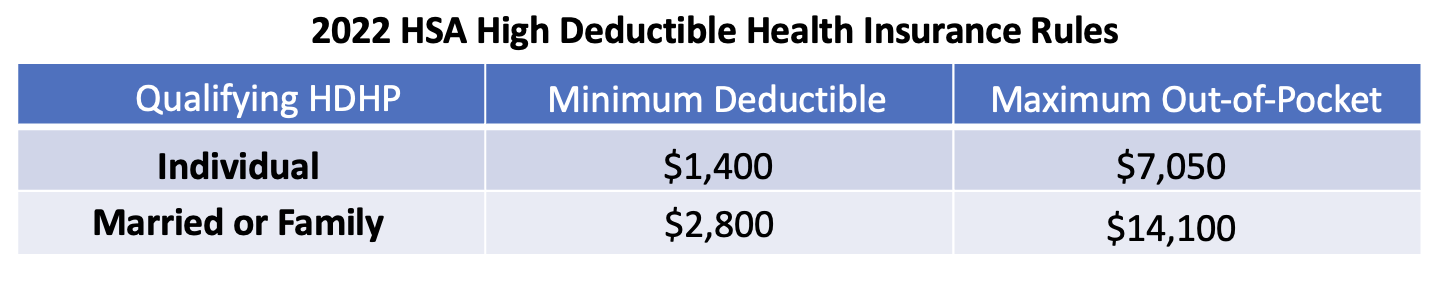

The biggest hurdle to starting and investing with a Health Savings Account is the ‘Health Insurance Issue’. In order to qualify for an HSA, you need to have a ‘High Deductible Health Plan’ oftentimes referred to as an HDHP. Under the tax law, HDHPs must set a minimum deductible and a limit, or maximum, on out-of-pocket costs. Here are the numbers for 2022:

Do I pay tax on HSA growth?

You don’t pay taxes on the growth or investment profits inside the Health Savings Account, just like a retirement account. That’s it. Plain and simple.

Remember, investment returns are NOT counted towards your annual contribution either. So…if you win big on investment inside your HSA, you still get to make another contribution when you ‘pass go’ every January.

What if I leave my employer, is it portable like IRA?

Yes, the Health Savings Account is yours much like an IRA (Individual Retirement Account). It’s not a “use it or lose it” plan. If you leave an employer sponsoring your HSA, you take the HSA with you no matter how long you worked there!

You don’t even have to own a business OR have a job to open and start an HSA. Again, the only requirement is HDHP insurance.

What are the deadlines for making the contribution?

There are three important deadlines you should be aware of. Again, opening the HSA is completely separate from making contributions. There is the process of paying for health care expenses or getting reimbursed.

- If you want the deduction in 2022, you have to enroll in a high-deductible health insurance plan (HDHP) before December 1st, 2022.

- If you have the proper HDHP by December 1st, 2022, you have until April 15, 2023, to make your tax-deductible contribution.

- Your deduction is based on the number of months in 2022 you had a qualified HDHP, and NOT when you made the contribution. Basically, you can take the deduction for the period you ‘could have made a deposit.

How to Set Up a Health Savings Account?

Once you have the proper HDHP insurance, you can oftentimes set up your HSA within minutes. Moreover, you can open an account for an HSA wherever you choose like Fidelity HSA, vanguard etc.

What are the qualified medical expenses for tax-Free Withdrawals?

Can I withdraw the HSA fund for non-healthcare expenses?

What Happens if I Die With Money in my Health Savings Account?

Related Articles

Roth IRA

What is a Roth IRA? A Roth IRA is an individual retirement account (IRA) in which money grows tax-free and come out tax free. What are the Roth IRA income limits for 2022? Roth IRA income limits for the 2022 tax year are $144,000 ($153,000 in 2023) ...Beneficial Ownership Information Reporting

Own a Small Business? Start Preparing Now for This New Reporting Regulation The Treasury Department is cracking down on shady business practices with a brand-new regulation. Starting on Jan. 1, 2024, small businesses must file a Beneficial Ownership ...Entity Formation Considerations

Business Purpose and Activities: What is the primary purpose of your business? What specific activities will your business be engaged in? Ownership and Management: Who are the owners of the business? What percentage of ownership does each owner have? ...Operating Business in California

Operating Business in California Legal Compliance: California Secretary of State (SOS) Filings: Corporations: California corporations are required to file a Statement of Information (Form SI-200) with the Secretary of State within 90 days of ...